In 2021, over 40% of the advice I provided to our clients was in the areas of personal, family or business protection. The specific needs being:

- Mortgage Protection

- Income Protection

- Family Protection (i.e. Life Insurance & Specified Serious Illness Cover)

- Shareholder Protection

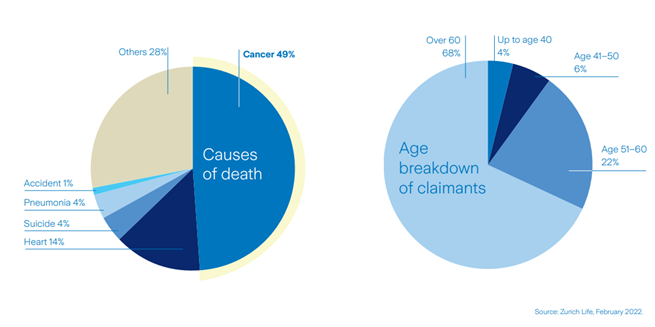

I firmly believe that everyone should have a plan in place to provide financial security should something happen to them. I recently carried out a review of the Life Insurance market to assess what benefits were paid out in 2021. My findings, which I’ve outlined below, show just how important this can be to an individual and their family as we never know what life has in store for us.

Life Cover

- The average of age of claims on death was 66

- 46% of death claims were cancer related, 13% heart related

Specified Serious Illness Cover

- Industry average age of claim for men was 54

- Industry average age of claim for women was 52

- 41% of claims for men were cancer related and 33% heart related

- 78% of claims for women were cancer related (of which an average of 32% of cancer claims were on the diagnosis of breast cancer).

Source: Aviva Protection Claims 2021

Income Protection

- Industry average age of claimant was 49

- Reason for claim

- Mental Health/Psychological = 24%

- Musculoskeletal = 21%

- Cancer = 19%

Source: Irish Life 2021 Protection Claims

I think the findings are very stark and show that it is a necessary element of a robust financial plan. No amount of money will relieve the upset of an unexpected death, illness or accident. But with proper planning you can alleviate the financial concerns a tragic event like this may bring.

If you’d like to talk about creating your individual plan just get in touch today.