This time last year, investment analysts were predicting a positive, albeit modest growth in the global stock market for 2021.

Looking back now we can see that most experts were too conservative in their assessments. The Global Stock Market finished off the year 32% up on the previous year.

There are a number of factors that led to that investment growth, not least the rise in energy stocks, a low interest rate environment as well as the continuing boom in technology related companies.

For our pension and long term savings clients who have their investments in well diversified funds, you have benefited from being invested in the great companies of the world.

The outlook for 2022 is for growth to continue but at a slower pace than what we have become used to.

Rising inflation has already meant that the great companies of the world have had to adjust their spending and all the signs are pointing toward the start of rising interest rates in the US. This will affect the ability for those companies to borrow and/or service their existing debt.

So while the market is expected to cool that doesn’t mean growth stops.

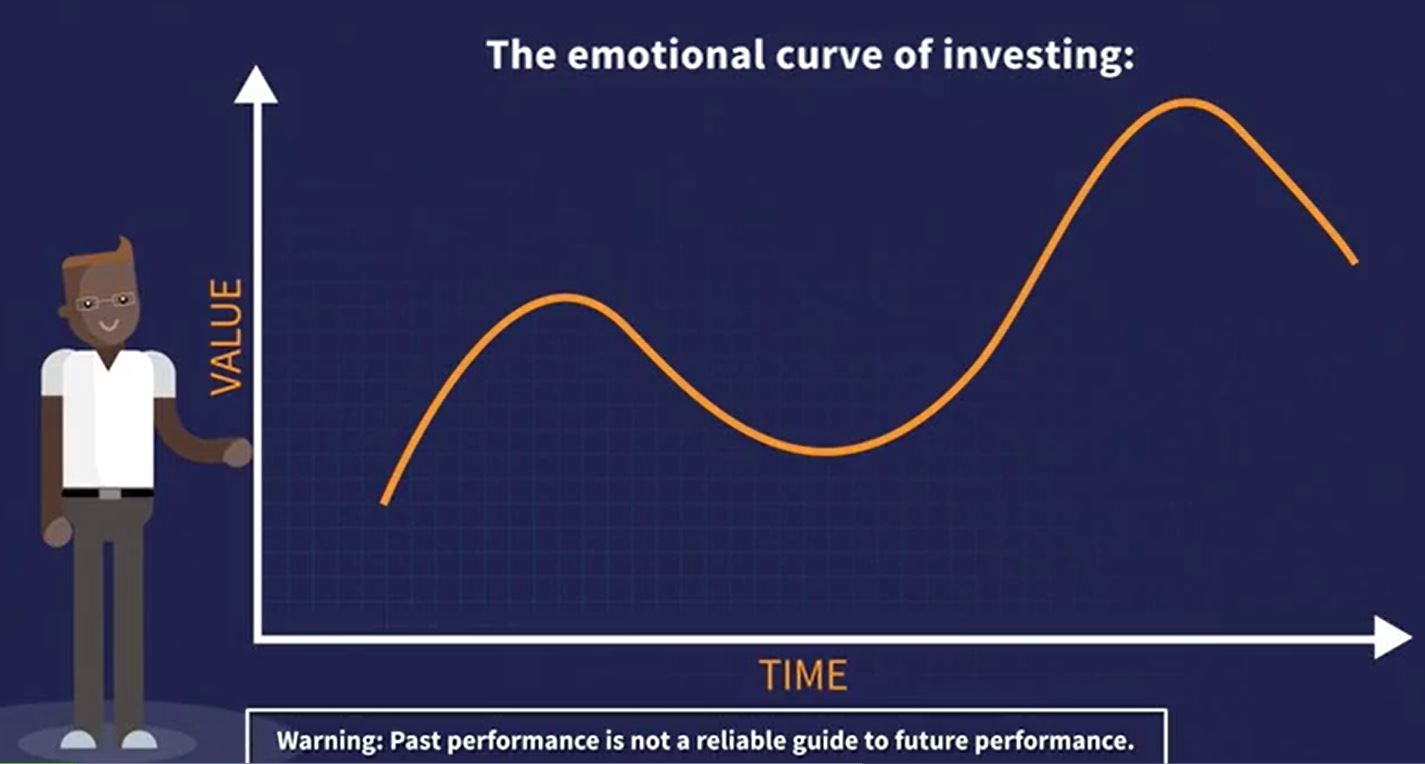

As investors with money in Pension funds or long term savings, the number 1 rule when markets are turbulent is to remain focused on your original objective and stick to the plan.

The following video is a great illustration of how to avoid falling into the emotional investment trap.

As always, if you have questions about your investments, savings or retirement planning, seek qualified impartial advice from a trusted adviser. You can contact us here for an initial chat.

As always, if you have questions about your investments, savings or retirement planning, seek qualified impartial advice from a trusted adviser. You can contact us here for an initial chat.